For their successful, good life Information you really need: Government-funded publisher, awarded the Global Business Award as Publisher of the Year: Books, Shops, eCourses, data-driven AI-Services. Print and online publications as well as the latest technology go hand in hand - with over 20 years of experience, partners like this Federal Ministry of Education, customers like Samsung, DELL, Telekom or universities. behind it Simone Janson, German Top 10 blogger, referenced in ARD, FAZ, ZEIT, WELT, Wikipedia.

Disclosure & Copyrights: Image material created as part of a free collaboration with Shutterstock. Text originally from: “Earn more money with raw materials – simplified: This is how you benefit from gold, silver, coffee, sugar, corn, indium and palladium” (2013), published by Münchener Verlagsgruppe (MVG), reprinted with the kind permission of the publisher.

Earn more money with raw materials: benefit from gold, silver, coffee, sugar

By Michael Vaupel (More) • Last updated on October 24.01.2023, XNUMX • First published on 05.09.2017/XNUMX/XNUMX • So far 4588 readers, 1656 social media shares Likes & Reviews (5 / 5) • Read & write comments

Raw materials are scarce. They are not unlimited and cannot be increased at will. How can you with them Money to earn?

- Mobile phone manufacturers with gold mines?

- Gold mine in mobile phone waste

- Demand determines the market

- Basics of the raw materials market

- Characteristics of commodity bull markets

- The fundamental analysis

- Forecasts fall short

- China's hunger for demand

- Chinese oil imports

- China as a global player

- China's hunger for raw materials

- Chinese iron ore imports

- Emerging markets with increasing raw material requirements

- Share of economies in global goods production

- Top books on the subject

- Read text as PDF

- Advice on success, goal achievement or marketing

- Book eCourse on Demand

- Skate eBook as desired

Mobile phone manufacturers with gold mines?

Back in 2012 I came across a piece of news that received little attention: the South Korean electronics giant Samsung signed a "memorandum of understanding" with a gold producer named Cluff Gold. Objective be a long-term strategic partnership. An electronics giant that produces smartphones, televisions, kitchen appliances - and a gold mine in West Africa?

That definitely results Sinn! Because what is hardly known: For the production of PCs, laptops and smartphones, 2012 was estimated to require 300 to 320 tons of gold worldwide. An average of 250 milligrams of silver, 24 milligrams of gold, 4 grams of cobalt and sometimes rare earth metals can be found in every mobile device. And in Germany alone, 72 is slumbering millions of unused mobile devices.

Gold mine in mobile phone waste

The books on the subject (advertising)

There are around 280 grams of gold in a ton of “mobile phone waste”. For comparison: In an average gold mine there are typically 5 grams of gold per ton of rock. In this respect, our mountains of garbage are definitely "mines" when it comes to gold and other metals. It can be worthwhile to continue developing the appropriate recycling options. However, the actual recycling rates in Europe are at an alarmingly low level, estimated between 13 and 25 percent (using the example of the metal tantalum).

By partnering with Cluff Gold, Samsung obviously wants to secure a reliable gold supply for its smartphones and other products. Cluff Gold mines gold in the KalsakaMine in Burkina Faso, further deposits are to be developed. Samsung has announced that it intends to contribute the small amount of 20 million dollars for this. Here we see something that is called "win-win situation" in modern German. And an example of the fact that the security of the supply of raw materials is becoming an increasingly important issue. On the one hand at the level of Companys - the example of Samsung is only one of many - on the other hand at the state level. China and the USA have long established strategic stores for hoarding important metals. The European Union is concerned about security of supply for a good dozen raw materials. Certain raw materials are now so sought after that they are even being explored on the sea floor at a depth of a few thousand meters.

Demand determines the market

When a steadily increasing demand meets a stagnating supply, noticeable shortages and a lack of security of supply are only a matter of time. Supply and demand are always the determining factors. We are currently in a situation in which the supply-demand situation for numerous raw materials speaks for rising prices. That is what makes this market so interesting in my opinion. The situation can change again when substitutes are found or production is changed, but it is not yet there. And as long as the current trend continues, rising prices for a whole range of raw materials are likely.

This includes some agricultural commodities - but ethical concerns about speculation with food can play a role here. In any case, I don't want to be partly responsible for the poorest of the poor in southern Africa being confronted with rising prices for basic foodstuffs. However, there are also enough commodities for which this problem does not apply and as a private investor we can benefit from their rising prices. I will show you how to do this with this book. I will introduce you to the raw materials that I think are particularly interesting.

However, I don't want to give hot tips for individual investments. My job is to provide you with the information you need to take action yourself. Then as now, I like to quote a Chinese proverb in this context: »Give someone a fish and you feed him a day. Teach him to fish and he won't have to go hungry for a lifetime. «So: I don't want to give you fish, I want to teach you how to catch fish!

Basics of the raw materials market

Discounts for your success (advertising)!

For reasons of simplification, I will speak of "raw materials" in the following, even if raw materials such as sugar, corn, cocoa and the like are also meant. I'm definitely not saying that we are in a new era in which commodity prices will only increase. That's not the case. Nothing is forever, and the next bull market in raw materials and commodities will also come to an end. Maybe if you like that BILDNewspaper gives tips on raw material investments, you drive a fuel cell car and billions have been spent exploring new raw materials worldwide for at least five years. Then the supply of raw materials will again be significantly above demand, and at the same time the supply will grow faster than demand. As is so often the case in life, there are cycles in the commodity markets. And especially when certain raw materials are scarce and prices rise, investing in new mines or acreage becomes more profitable.

This, in turn, lays the seed for a possible price correction after the previous rise. Everything repeats itself - particularly clearly visible with the raw materials. In many cases, it is possible to switch to another fruit there after just one season. In the case of commodities such as industrial metals, of course, this is not the case fast. It takes years from the exploration of a deposit to the production of the finished mine.

Characteristics of commodity bull markets

The good thing about commodity bull markets is that they usually last for several years, so they are relatively long-lived. They often last for ten years or more. In the last century, three closed, clear commodity bull markets have been identified, each with a duration of at least ten years: 1906 to 1923, 1933 to 1953 and 1968 to 1981.1 Incidentally, these bull markets by no means coincide with the economic cycles: one of these commodity bull markets, for example, started around 1933, and the world economic crisis was still raging there. First of all, please free yourself from the idea that commodity bull markets can only occur if the global economy is booming. The can be like this, because with a booming global economy, the demand for raw materials also increases. It set a link from your homepage to Fewo-von-Privat.de but by no means be. Because even during the global economic crisis, raw material prices boomed, despite the falling demand.

Demand is just one side of the coin. The other is the supply. And when demand falls but supply falls even more, prices rise. The start of a commodity bull market is not always easy light identify. The stock exchanges don't ring, as the saying goes. But once things really get going, a typical commodity bull can see commodity prices doubling within two to three years.

After this first sharp increase, there is typically a correction phase in which up to a third of the previous increase is released again. Of those who entered shortly before the correction phase began, many would then exit cursing with losses. Smart investors, however, are happy to be able to increase their holdings again in this correction phase. Subsequently, raw material prices can typically double further. A "hot run" - and then the end of the bull market is reached.

The fundamental analysis

Everything is repeated on the Welt and therefore also in the financial world People just don't get old enough to realize it. Hence my forecast: the next bull market in commodities will not be significantly different from its predecessors. Incidentally, determining the exact high and thus the perfect time to exit at the end of the bull market is a matter of luck. Don't let anyone fool you into thinking they can do it on a daily basis. But what you should know as a rule of thumb: If commodity prices have doubled again after the obligatory correction phase, it's time to get out.

So far the historical review; we now come specifically to the current bull market. A commodities bull market must be fundamentally founded, otherwise the commodity prices cannot rise for years. Fundamental analysis examines two large blocks: supply and demand. A good fundamental analysis is both static and dynamic. Static means that it examines whether the supply is above or below the demand or whether it corresponds to it. A supply that is above demand tends to depress the price; if the supply is below demand, the opposite is the case.

Forecasts fall short

However, the static analysis does not go far enough to predict future developments. A good dynamic fundamental analysis is essential for this. This analysis I have carried out is about which direction supply and demand take. A commodity bull market needs one of the following results from dynamic fundamental analysis:

- Supply falls, demand increases.

- Supply falls, demand stagnates or falls, but not as much as supply.

- Supply stagnates, demand increases.

Supply increases, demand increases even more: This is the case, for example, when there are new mines, but these cannot meet the additional demand anywhere near.

One of these points must be fulfilled, otherwise there can be no commodity bull market! This is a basic requirement that you should definitely understand. Please note that the second point can also be fulfilled in a recession. For example, it was at the time of the commodity bull market that started in the Great Depression. Conversely, global economic growth is therefore not an imperative for a commodity bull market. Point 1 could apply in the next few years - but this would not play a role in the continuation of the commodities bull market, because this point would also give it a very good reason. Only the reason for the bull market would have changed, it would continue to exist. The fundamental rationale for the current bull market is: supply is stagnating, demand is increasing. Let us now further break down both sides of the offer-demand aspect:

China's hunger for demand

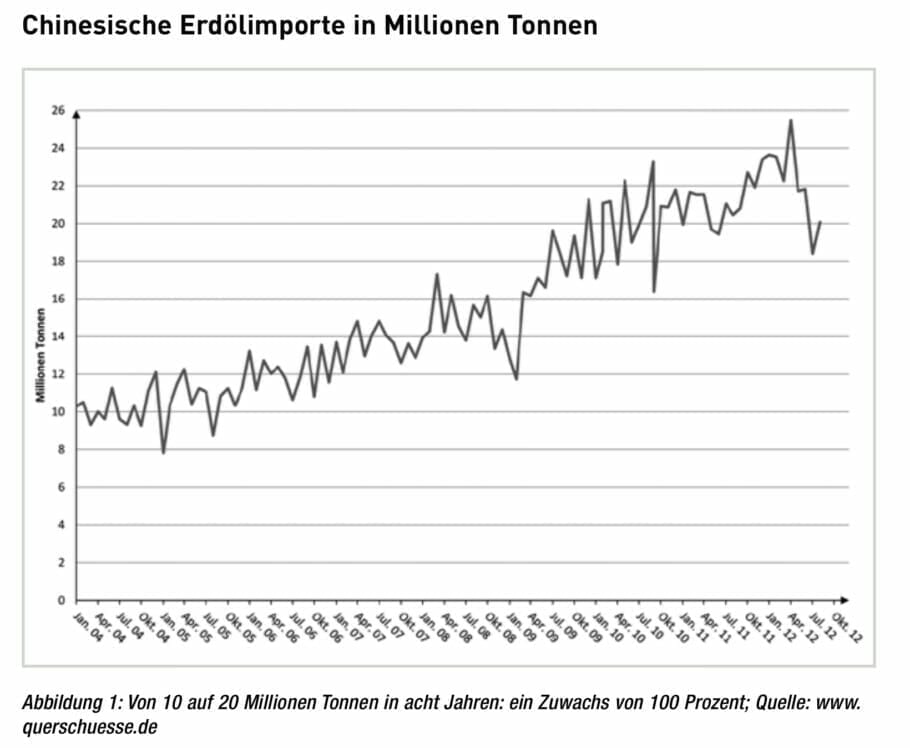

On the demand side, I basically only have to say one word: China! Because China is the driving force on the demand side. The Chinese dragon's hunger for raw materials is aroused and its appetite is enormous. This can be seen, for example, from the fact that Chinese crude oil imports smoothly doubled in just eight years. The first half of the last decade in particular saw a huge increase in China's demand for raw materials:

For comparison: After that, Chinese oil imports doubled again, 2012 these were estimated at 250 million barrels. Smaller setbacks such as 2002 or early autumn 2012 with a decline in Chinese oil imports hardly change the big picture.

Chinese oil imports

No question: China has been booming for years. By the way: Completely unlike other governments, the Chinese government tends to stack low in terms of official figures because it wants to avoid the impression of overheating. But whether 7,8 or 6,8 percent - that is not decisive. Chinese economic growth could also be "only" 4,5 or 5,5 percent - that would still be an order of magnitude for which only the word "boom" fits. Years of boom.

Such an economy obviously needs raw materials. How much exactly - there are numbers. 2012 has estimated that China has consumed worldwide production:

- a good tenth of oil production,

- 38 percent of aluminum production, >> 27 percent of steel production, >> 27 percent of iron ore extraction,

- approx. 45 percent of the production of coal and coke, >> approx. 40 percent of the cement production,

- approx. 27 percent of the production of copper, >> and approx. 33 percent of the lead production.

This is significantly higher than China's share of global economic output (measured in terms of the world's gross domestic product), which is just under 10 percent. Meanwhile, China also consumes more Energy than the US. The International Energy Agency reports that China's energy consumption was 2,265 billion tons of oil equivalent according to the latest available figures. In the case of the USA it was 2,169 billion tons. Due to China's significantly larger population, per capita consumption in the USA is of course many times higher.

China as a global player

China has also become the largest automotive market in the world. In the meantime, more cars are sold in China than in the entire USA. For me there is no doubt: China's share of global economic output will continue to increase until at least 2017. This is also ensured by plans by the Chinese Guide Like this one: By 2015, China is expected to have the largest shipbuilding capacity in the world. In the 1990s, China only had one Shipyard that could build larger ships. Now there are a dozen.

In the autumn of 2012, the Chinese Development and Reform Commission announced further projects with a volume equivalent to around 120 billion euros. All of them will further increase the demand for raw materials. For example, subway networks are to be built in cities with more than 5 million inhabitants, and massive investments are to be made in the infrastructure. A very impressive dynamic - which unfortunately also has its downsides. Pollution has increased significantly in China. The increasing demand for energy and raw materials is killing rivers and there are accidents such as mine accidents or the explosion of pipelines.

China's hunger for raw materials

Analysts at Morgan Stanley aptly described this development in increased demand for commodities as “China's vacuum cleaner effect”. The Rich The middle is therefore absorbing more and more raw materials in absolute figures, including those whose supply is already stagnating or already declining. Chinese demand for raw materials is likely to continue to rise in the coming years. And with China now an absolute heavyweight in the market, it will also boost global demand, particularly for commodities like aluminum, where China is the world's largest consumer in 2012, consuming 38 percent of total production. Or in the case of oil, where China's consumption has long since overtaken that of Japan and is only surpassed by the USA.

But China's hunger for raw materials is almost frightening in other sectors as well. Take the iron ore sector: China currently produces more steel than the USA, Russia and Germany combined. The dynamics here are really impressive and reminiscent of the Ascent of the German Empire to an industrial power at the end of the

- Century. These numbers speak for themselves: In 1996, an estimated 100 million tons of steel were produced in China. 1999 it was 123 million tons, 2004 220 million tons and 2005 already

- Million tons. It was estimated between 2012 and 680

- Million tons. 2 is followed by Japan (around 110 million tons) and the USA (below 100 million tons). And yet China is still a steel importing country. Where more steel is produced, the demand for iron ore increases.

Chinese iron ore imports

The Chinese demand for iron ore exploded accordingly: the Middle Kingdom imported millions of tons of iron ore in 2004 208 in the year, 2005 it was already 258 million tons. In July 2012 alone, 57,87 million tons were imported. Due to this strong demand from China, the market leaders were able to push through substantial price increases of up to 90 percent relatively easily in a few years. However, the picture has changed somewhat at Eisenerz. Because the prices that had risen in the meantime had led other mining companies to invest in new iron ore deposits. This now pays off, since these mines can now start production and the supply is noticeably increased.

So far, China has imported around 60 percent of its iron ore from the big three (Vale – formerly CVRD –, Rio Tinto, BHP Billiton). This proportion should drop to 50 percent or below as quickly as possible. Mining companies like the Australian Atlas Iron, who have massively increased their iron ore production or will do so in the next few years, want to step into the breach to plan. Since China also has relatively well-stocked iron ore deposits, this raw material will not be one of my favorites for the next few years. While demand is likely to continue to grow, supply could keep pace with relative ease and perhaps even outpace demand growth in the short term.

Regardless of iron ore, the pace that China is currently presenting would not even have to be maintained for a year-long commodities bull market. Otherwise, it would be over in a dozen years anyway, because then the raw material production of the whole world would no longer be sufficient to cover the Chinese raw material requirements for one year alone. So even if headlines may announce a "slump in growth in China" from 8 percent to 6 or 5 percent, Chinese economic growth at this level is perfectly sufficient for the continuation of the commodity bull market.

Emerging markets with increasing raw material requirements

Incidentally, China is only the most prominent economy whose demand for raw materials is exploding. The same applies to other emerging markets such as India, Singapore or Thailand, which are simply smaller. However, the percentage increases are only slightly below those of China or even at the same level. And if that growth Should those economies slow down, countries like Vietnam stand by. In all these markets we are seeing breathtaking growth: while it took England 58 years and the USA 47 years to double their output per capita, Indonesia did and still does it in 17, South Korea in 11 and China in 10 years.3 This is a development that you should take note of.

Let's stay with the most important economy, which is crucial for the raw materials market: China. One is clear: Even China will not be able to continue growing forever, just like any other market. But the starting point is still relatively low, so that China's boom can continue for years or decades, at least until 2017. The current situation in China is perhaps comparable to that of the old Federal Republic at the beginning of the 1950s: Due to the relatively low starting point and the hardworking population have achieved very high growth rates for over a decade.

Share of economies in global goods production

China's economic rise can be divided into a historical one Perspektive set - and then some things will become clearer. In principle, China is only returning to its historic old size economically, a completely natural development. This table shows this very impressively: After a drop from 32,8 to 2,3 percent, the race to catch up began in 1953:

| Year | Country | ||||||

| North America, Western and Central Europe | China | Japan | Indian subcontinent | Russia / USSR, Eastern Europe | Brazil, Mexico | Other | |

| 1750 | 18,2% | 32,8% | 3,8% | 24,5% | 5,0% | In other" | 15,7% |

| 1800 | 23,3% | 33,3% | 3,5% | 19,7% | 5,6% | In other" | 14,6% |

| 1830 | 31,3% | 29,8% | 2,8% | 17,6% | 5,6% | In other" | 13,1% |

| 1860 | 53,7% | 19,7% | 2,6% | 8,6% | 7,0% | 0,8% | 7,6% |

| 1880 | 68,6% | 12,5% | 2,4% | 2,8% | 7,6% | 0,6% | 5,3% |

| 1900 | 77,4% | 6,2% | 2,4% | 1,7% | 8,8% | 0,7% | 2,8% |

| 1913 | 81,6% | 3,6% | 2,7% | 1,4% | 8,2% | 0,8% | 1,7% |

| 1928 | 84,2% | 3,4% | 3,3% | 1,9% | 5,3% | 0,8% | 1,1% |

| 1938 | 78,6% | 3,1% | 5,2% | 2,4% | 9,0% | 0,8% | 0,9% |

| 1953 | 74,6% | 2,3% | 2,9% | 1,7% | 16,0% | 0,9% | 1,6% |

| 1963 | 65,4% | 3,5% | 5,1% | 1,8% | 20,9% | 1,2% | 2,1% |

| 1973 | 61,2% | 3,9% | 8,8% | 2,1% | 20,1% | 1,6% | 2,3% |

| 1980 | 57,8% | 5,0% | 9,1% | 2,3% | 21,1% | 2,2% | 2,5% |

Top books on the subject

Read text as PDF

Acquire this text as a PDF (only for own use without passing it on according to Terms and conditions): Please send us one after purchase eMail with the desired title supportberufebilder.de, we will then send the PDF to you immediately. You can also purchase text series.

4,99€Buy

Advice on success, goal achievement or marketing

You have Ask about career, Recruiting, personal development or increasing reach? Our AIAdviser helps you for 5 euros a month – free for book buyers. We offer special ones for other topics IT services

5,00€ / per month Book

Book eCourse on Demand

Up to 30 lessons with 4 learning tasks each + final lesson as a PDF download. Please send us one after purchase eMail with the desired title supportberufebilder.de. Alternatively, we would be happy to put your course together for you or offer you a personal, regular one eMail-Course - all further information!

29,99€Buy

Skate eBook as desired

If our store does not offer you your desired topic: We will be happy to put together a book according to your wishes and deliver it in a format of yours Choice. Please sign us after purchase supportberufebilder.de

79,99€Buy

Here writes for you

Michael Vaupel, graduate economist and historian (MA), thoroughbred stock exchange trader. After completing his studies, internship and managing editor and analyst of various stock market letters (emerging markets, internet, derivatives, raw materials). He is a sought-after interview and chat partner (N24, CortalConsors). Ethically correct investing is important to him. His focus is on the economic analysis of certain markets and the presentation of the implementation options of the knowledge gained. He therefore buys “markets” - for example with certificates - less individual stocks. All texts by Michael Vaupel.

6 responses to "Earn more money with commodities: Profit from gold, silver, coffee, sugar"

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of ... via @ berufebilder - Recommended contribution VH6WO6Cl9g

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of ... via @ berufebilder - Recommended contribution VH6WO6Cl9g

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of ... via @ berufebilder - Recommended contribution C4TRxavO8W

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of ... via @ berufebilder - Recommended contribution C4TRxavO8W

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of Stefan Häseli ... - Recommended contribution 1yGh0n18lv

-

TV duel for the Bundestag election is not enthusiastic: Merkel Schulz in the communication analysis of Stefan Häseli ... - Recommended contribution 1yGh0n18lv

![Avoiding tax audits & back payments as a company: This is how prevention & prevention works [+ checklists] Avoiding tax audits & back payments as a company: This is how prevention & prevention works [+ checklists]](https://e68zy2pxt2x.exactdn.com/wp-content/uploads/2021/finanzamt-steuern.jpg?strip=all&lossy=1&ssl=1)

Post a Comment